All about Eb5 Investment Immigration

Table of ContentsThe Buzz on Eb5 Investment ImmigrationThe Greatest Guide To Eb5 Investment ImmigrationEb5 Investment Immigration for BeginnersTop Guidelines Of Eb5 Investment ImmigrationEb5 Investment Immigration Things To Know Before You Buy

While we strive to offer exact and up-to-date web content, it must not be thought about legal guidance. Migration laws and policies go through change, and private scenarios can differ widely. For customized guidance and legal guidance concerning your certain immigration scenario, we strongly recommend consulting with a certified immigration lawyer who can offer you with customized support and guarantee compliance with present laws and regulations.

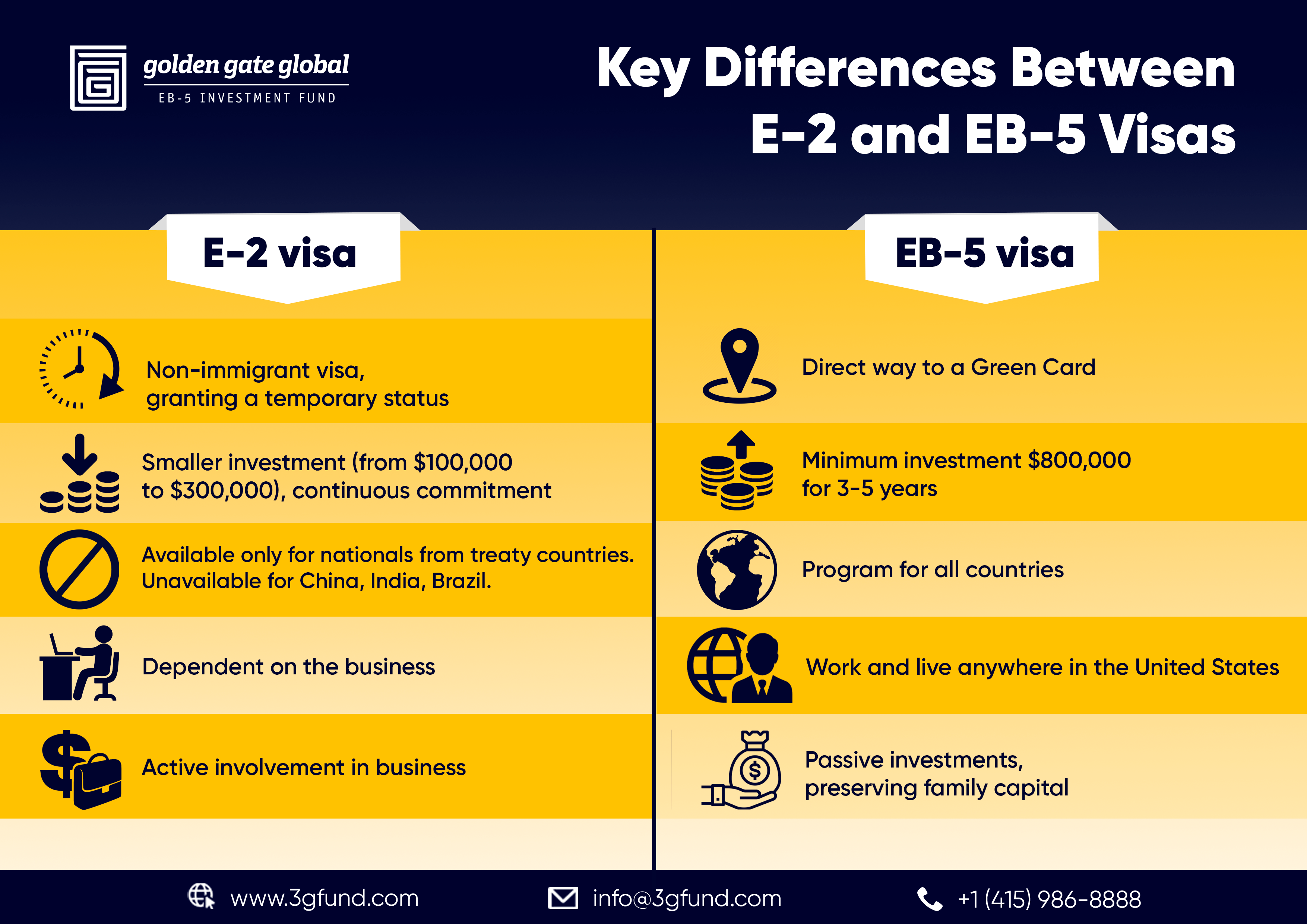

Citizenship, through financial investment. Currently, as of March 15, 2022, the amount of investment is $800,000 (in Targeted Work Locations and Backwoods) and $1,050,000 in other places (non-TEA areas). Congress has approved these quantities for the following 5 years beginning March 15, 2022.

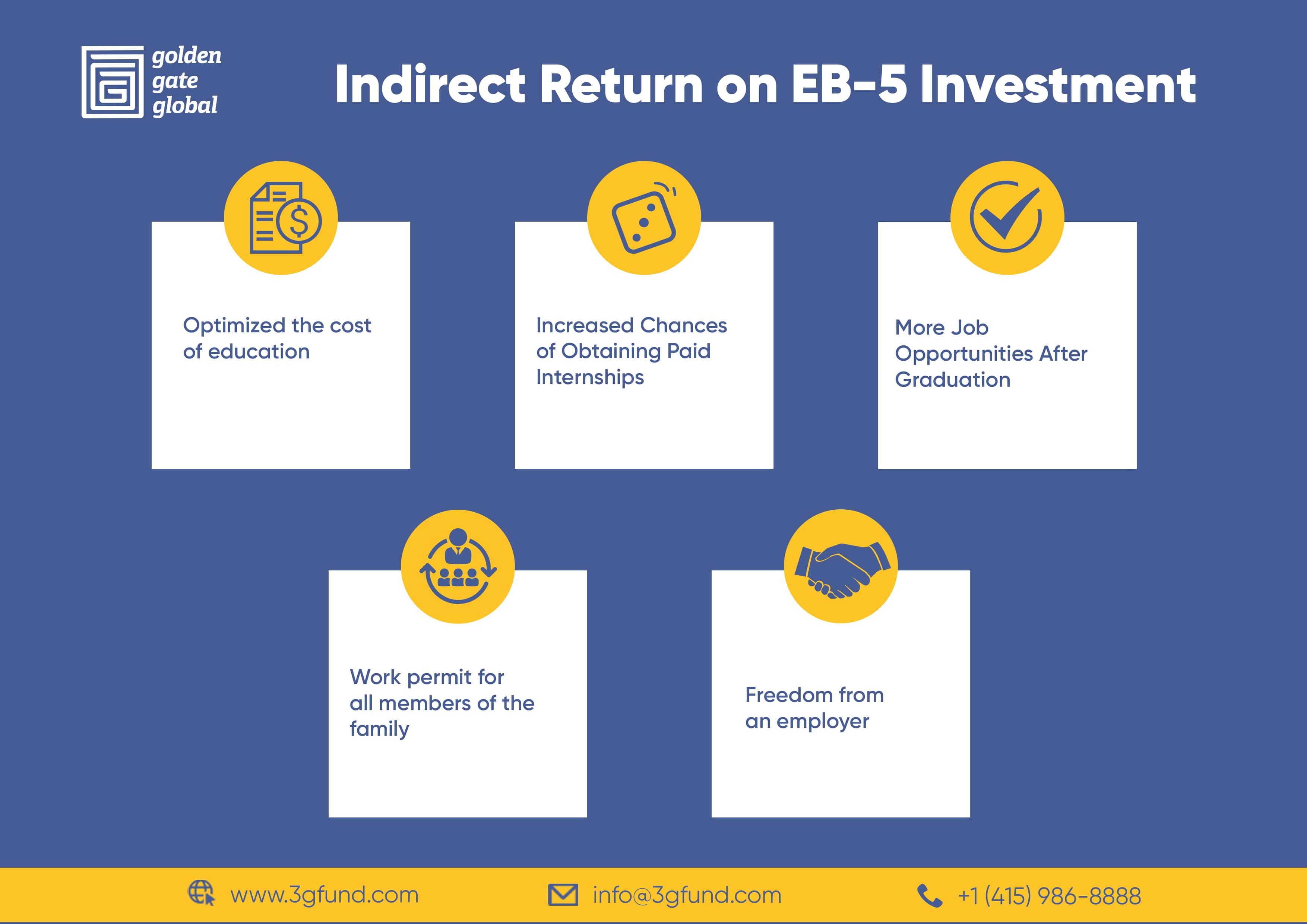

To receive the EB-5 Visa, Investors need to develop 10 permanent united state jobs within 2 years from the day of their complete financial investment. EB5 Investment Immigration. This EB-5 Visa Need ensures that financial investments add directly to the U.S. work market. This applies whether the jobs are produced straight by the industrial business or indirectly under sponsorship of a designated EB-5 Regional Center like EB5 United

How Eb5 Investment Immigration can Save You Time, Stress, and Money.

These work are figured out via versions that utilize inputs such as advancement prices (e.g., building and construction and equipment costs) or annual revenues produced by ongoing procedures. In contrast, under the standalone, or direct, EB-5 Program, just straight, full time W-2 staff member settings within the company might be counted. A crucial threat of relying only on direct workers is that team reductions because of market conditions can cause insufficient full-time settings, potentially causing USCIS denial of the financier's petition if the work creation need is not fulfilled.

The financial model then forecasts the variety of direct tasks the brand-new business is likely to create based upon its expected revenues. Indirect work calculated with financial designs refers to work generated in industries that supply the products or services to the organization directly included in the task. These work are produced as a result of the raised need for items, materials, or services that support the business's operations.

Getting The Eb5 Investment Immigration To Work

An employment-based fifth choice category (EB-5) investment visa gives a method of ending up being an irreversible U.S. local for international nationals wishing to invest funding in the United States. In order to apply for other this copyright, an international financier has to invest $1.8 million (or $900,000 in a Regional Center within a "Targeted Employment Location") and Going Here produce or preserve at the very least 10 permanent tasks for USA workers (excluding the investor and their immediate household).

This measure has actually been an incredible success. Today, 95% of all EB-5 funding is increased and invested by Regional Centers. Considering that the 2008 monetary dilemma, access to capital has been restricted and community budget plans remain to encounter substantial shortfalls. In several areas, EB-5 financial investments have filled the funding space, offering a brand-new, crucial resource of capital for regional financial advancement jobs that renew communities, create and sustain tasks, facilities, and services.

What Does Eb5 Investment Immigration Mean?

workers. Furthermore, the Congressional Spending Plan Workplace (CBO) racked up the program as revenue visite site neutral, with management prices spent for by applicant costs. EB5 Investment Immigration. Greater than 25 nations, consisting of Australia and the UK, use comparable programs to draw in international investments. The American program is more rigorous than many others, needing substantial danger for financiers in terms of both their monetary investment and migration condition.

Families and individuals that seek to relocate to the United States on an irreversible basis can use for the EB-5 Immigrant Investor Program. The United States Citizenship and Migration Services (U.S.C.I.S.) set out various demands to acquire irreversible residency via the EB-5 visa program.: The very first action is to find a qualifying investment opportunity.

Once the chance has been identified, the financier has to make the investment and send an I-526 petition to the U.S. Citizenship and Immigration Provider (USCIS). This application should include proof of the financial investment, such as bank declarations, purchase contracts, and service plans. The USCIS will examine the I-526 request and either approve it or demand added proof.

Some Known Details About Eb5 Investment Immigration

The investor must make an application for conditional residency by sending an I-485 request. This application needs to be submitted within 6 months of the I-526 approval and must include evidence that the investment was made which it has actually produced at the very least 10 full time jobs for U.S. workers. The USCIS will certainly review the I-485 application and either accept it or demand extra proof.